Your Trusted Guide to Investing in Real Estate Canada

When investing in Real Estate Canada, it is crucial to understand that it is a decision that requires careful consideration. The good news is that the process can be manageable, and asking the right questions and seeking guidance from a trusted professional can help simplify it.

If you’re looking for houses for sale in Mississauga or other cities, this article offers valuable insights into what you should know before investing in real estate.

Table of Content

- 1 1. What government assistance programs are offered in Canada to support homebuyers?

- 2 2. What is the minimum down payment required for purchasing a home in Canada?

- 3 3. As a seller, what steps should I take to ensure my property is priced appropriately?

- 4 4. What are the closing costs of buying a home in Canada?

- 5 5. How can you choose the right mortgage for you?

- 6 Stay in Touch!

1. What government assistance programs are offered in Canada to support homebuyers?

The Canadian government offers several assistance programs for home buyers, including the following:

- First-Time Home Buyer Incentive: An eligible first-time homebuyer with a minimum down payment can finance a portion of their home purchase through a shared equity mortgage with the Government of Canada.

- Home Buyers’ Amount: Offers a $5,000 non-refundable income tax credit on a qualifying home acquired during the year, providing up to $750 in federal tax relief for eligible individuals.

- Home Buyers’ Plan (HBP): Allows individuals to withdraw up to $35,000 in a calendar year from their registered retirement savings plans to buy or build a qualifying home for themselves or for a related person with a disability.

- GST/HST New Housing Rebate: Qualifying individuals may receive a rebate on part of the GST or HST paid on the purchase price, cost of building or renovating a home, or converting a non-residential property into a house.

- CMHC Eco Plus: Provides rebate grants of up to 25% on your mortgage loan insurance premium for eligible homeowners

Additional programs are available at the provincial or territorial level. It’s important to research the available programs and eligibility requirements to determine which ones may be applicable to your situation.

2. What is the minimum down payment required for purchasing a home in Canada?

The minimum down payment required for purchasing a home in Canada depends on the property’s purchase price.

- For properties with a purchase price of up to $500,000, the minimum down payment required is 5% of the purchase price.

- For properties with a purchase price between $500,000 and $1 million, the minimum down payment required is 5% of the first $500,000 and 10% of the portion of the purchase price over $500,000.

- For properties with a purchase price of $1 million or more, the minimum down payment required is 20% of the purchase price.

It’s important to note that while a minimum down payment of 5% is allowed, a larger down payment can help reduce the amount of interest paid over the life of the mortgage and may also result in a lower monthly mortgage payment. Additionally, if the down payment is less than 20% of the purchase price, mortgage default insurance is required, pushing the costs.

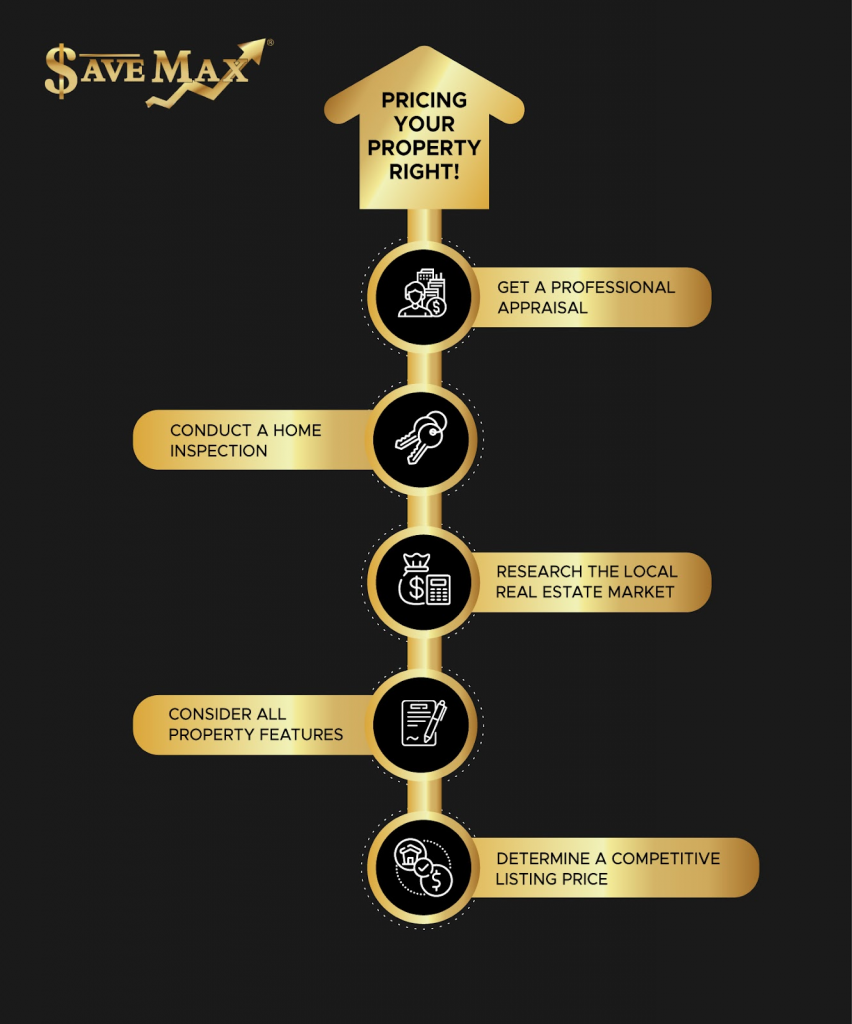

3. As a seller, what steps should I take to ensure my property is priced appropriately?

Pricing a property correctly is essential to a successful sale. As a seller, there are several steps you can take to ensure that your property is priced appropriately.

- Consider hiring a professional appraiser or real estate agent to conduct a property valuation. This can help you understand the fair market value of your property and provide a starting point for determining a listing price.

- Conduct a home inspection to identify any potential issues or repairs that may need to be addressed before listing the property. This can help you accurately assess the value of the property and make any necessary repairs or improvements that could increase its value.

- Researching the local real estate market and comparable properties in the area can also help you determine a competitive listing price. It’s important to consider factors such as the property’s location, size, age, condition, and features when determining its value.

Ultimately, pricing a property correctly requires careful consideration and research. Working with a professional appraiser or real estate agent can help you determine the appropriate price for your property and increase your chances of a successful sale.

Consult the professionals to get the pricing right!

4. What are the closing costs of buying a home in Canada?

Closing costs are the legal and administrative fees paid when a home purchase deal closes in Canada. These costs can vary based on location, property type, and purchase price, typically ranging from 1.5% to 4% of the purchase price.

Here are some common closing costs associated with buying a home in Canada:

- Legal fees: This includes the cost of hiring a lawyer or notary to handle the legal aspects of the purchase. Legal fees can range from $500 to $2,500.

- Title insurance: This insurance protects the homeowner against any defects in the property’s title. The cost of title insurance can range from $200 to $500.

- Home inspection: A home inspection is strongly recommended to identify any potential issues with the property. The cost of a home inspection can range from $300 to $500.

- Property appraisal: A property appraisal is often required by lenders to determine the property’s market value. The cost of a property appraisal can range from $300 to $500.

- Land transfer tax: This tax is payable to the provincial government upon the transfer of the property title. The amount of land transfer tax varies by province and can range from 0.5% to 2% of the purchase price.

- Mortgage insurance: If the down payment is less than 20% of the purchase price, mortgage insurance may be required. The cost of mortgage insurance varies based on the down payment amount and the lender’s requirements.

- Moving costs: The cost of moving belongings from the old home to the new home can vary depending on the distance and the number of items to be moved.

It is important to remember that these are just some of the common closing costs associated with buying a home in Canada. There may be additional fees depending on the specific circumstances of the purchase.

5. How can you choose the right mortgage for you?

A mortgage is a loan that is taken out to purchase a home, with the home serving as collateral for the loan. Many financial institutions in Canada offer mortgages, including banks, credit unions, and pension funds. When choosing a mortgage, there are various options to consider, such as the mortgage term (ranging from six months to 10 years) and the amortization period (the length of time to repay the loan).

In addition to these factors, there are also several types of mortgages available, including:

- Fixed-rate mortgages: With this type of mortgage, the interest rate remains the same for the entire mortgage term.

- Variable-rate mortgages: The interest rate on a variable-rate mortgage can fluctuate based on changes in the prime lending rate, which can affect your mortgage payments.

- Open mortgages: This type of mortgage allows you to make additional payments or pay off the entire mortgage balance at any time without penalty.

- Closed mortgages: Closed mortgages typically have lower interest rates, but you cannot make additional payments or pay off the mortgage balance without incurring a penalty.

- High-ratio mortgages: If you have less than a 20% down payment, you will likely need a high-ratio mortgage, which requires mortgage default insurance.

- Conventional mortgages: A conventional mortgage is for borrowers with a down payment of 20% or more and do not require mortgage default insurance.

To choose the right mortgage for you, it is important to consider your financial situation and goals and your comfort level with risk. Using a mortgage calculator or talking to a financial institution, lender, or mortgage broker can also help you make an informed decision.

Stay in Touch!

Don’t hesitate to contact us if you have any more questions. We are here to assist you and simplify the home-buying process.

This is the second in a series that aims to answer common questions about Canadian real estate. We will continue to provide informative articles and helpful tips for navigating the market. Keep checking back for more updates!