Bank of Canada Interest Rate Announcement: What It Means for First-Time Homebuyers in June 2024

The Bank of Canada announced its first cut in quite some time, a 0.25% decrease that brings the overnight interest rate to 4.75%.

For a first-time homebuyer, the Bank of Canada’s interest rate announcement is a crucial event that impacts your homebuying journey. The central bank’s decisions on interest rates directly influence mortgage rates, which in turn affects your ability to afford and secure a home.

In this article, we’ll explore the implications of the Bank of Canada’s interest rate announcement in June 2024 and provide insights to help you navigate the home-buying process.

Table of Content

- 1 How the Bank of Canada Interest Rate Affects Mortgage Rates

- 2 Implications of the Bank of Canada’s June 2024 Interest Rate Cut

- 3 Factors Influencing Interest Rates

- 4 Tips for First-Time Homebuyers in a Dynamic Environment

- 5 Use a Mortgage Calculator to Determine Affordability

- 6 Financial Planning for First-Time Homebuyers

- 7 Available Resources and Support for First-Time Homebuyers

- 8 Conclusion and Key Takeaways

How the Bank of Canada Interest Rate Affects Mortgage Rates

The Bank of Canada’s benchmark interest rate is also known as the overnight rate and serves as the reference point for other interest rates in the country’s economy, including mortgage rates.

When the central bank increases the overnight rate, it usually leads to higher mortgage rates. On the other hand, a decrease in the overnight rate can result in lower mortgage rates, making it more affordable for you to borrow money for your next home.

If you are a first-time homebuyer, the timing of your home purchase can have a significant impact on your financial situation.

Keeping a close watch on the Bank of Canada’s interest rate announcements and understanding how they can affect your mortgage rates can help you make the right decisions about when to enter the housing market. By acting at the right time, you can shave several thousand dollars over the life of your mortgage.

Implications of the Bank of Canada’s June 2024 Interest Rate Cut

Since this is the first time the BoC has adjusted its key interest rate since July 2023, the rate cut has important implications for homeowners.

This is good news for homeowners who have opted for variable-rate mortgages. Lower interest rates mean more of their monthly payments will go towards paying off the mortgage itself rather than interest, helping them pay off their mortgages faster.

Homeowners with fixed-rate mortgages might find some relief from the rate cut, but it is not a complete solution to affordability issues.

Those renewing fixed-rate mortgages could still face higher rates compared to the low rates they received a couple of years ago. Therefore, it is vital for these homeowners to review their finances and mortgage options to see how the rate change will affect them.

Factors Influencing Interest Rates

How and why the Bank of Canada decides interest rates is influenced by a variety of economic factors, including:

- Inflation Rates

- Unemployment Levels

- GDP Growth

- Consumer Spending Patterns

- Global Economic Conditions

These factors, along with the Bank of Canada’s monetary policy objectives, shape the interest rate environment that homebuyers will face in the housing market.

Tips for First-Time Homebuyers in a Dynamic Environment

To effectively steer through the home-buying process, consider the following tips:

- Stay Informed: Follow the Bank of Canada’s interest rate announcements closely and monitor economic indicators that can influence mortgage rates.

- Prequalify for a Mortgage: Work with a lender to get prequalified for a mortgage. This can give you a better understanding of your borrowing capacity. Further, this gives you clarity on your home search.

- Act Quickly: If you think that interest rates will rise, consider bringing forward your timelines to lock in a favourable mortgage rate.

- Explore Mortgage Options: Familiarize yourself with different mortgage products, such as fixed-rate and variable-rate mortgages, to determine which is best for your financial situation.

- Utilize a Mortgage Calculator: Use an online mortgage calculator to help estimate your potential monthly payments and determine your affordability based on different interest rate scenarios.

Use a Mortgage Calculator to Determine Affordability

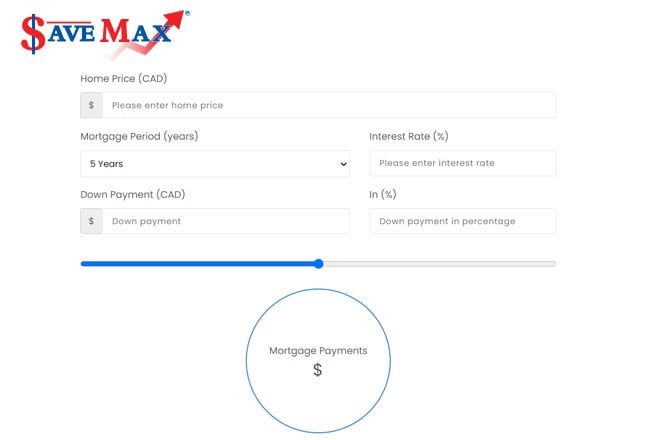

One of the most valuable tools for first-time homebuyers is the Save Max mortgage calculator.

Just input basic information such as the home price, down payment, and interest rate, and our mortgage calculator will provide you with an estimate of your monthly mortgage payments and the total cost of the loan over its lifetime.

This will help you understand the implications of different interest rate scenarios and make the right decisions.

Financial Planning for First-Time Homebuyers

Preparing for homeownership is not as easy as just securing a pre-approved mortgage.

As a first-time homebuyer, work on a comprehensive financial plan that includes the various costs that are part and parcel of owning a home, such as property taxes, insurance, maintenance, and utilities.

By creating a detailed budget, you can ensure that you’re financially ready to take on the responsibilities of homeownership, even in a changing interest rate environment.

Available Resources and Support for First-Time Homebuyers

There are several resources and support systems available to assist first-time homebuyers. From government programs and financial institutions to real estate professionals and online tools, you can access information easily.

Consult a reputable real estate brokerage to help you make informed decisions about your homeownership goals.

Conclusion and Key Takeaways

The Bank of Canada’s interest rate cut in June 2024 will impact first-time buyers’ homebuying journey.

By understanding the relationship between interest rates and mortgage rates, staying informed about economic factors, and utilizing tools like mortgage calculators, you can thrive in this dynamic housing market.

Remember, with proper planning, financial preparation, and access to the right resources, you can overcome the challenges and realize your dream of homeownership. And of course, we are ready to help you in any which way we can!