Secure Your Dream Home: Insider Tips for a Successful Mortgage Application in Canada

For many a potential Canadian homebuyer, the mortgage application process can feel like a maze. Whether it’s your first time applying for a mortgage, refinancing, or renegotiating an existing one, a successful mortgage application in Canada requires paying attention to every detail. Sometimes, errors or omissions in your application can lead to a mortgage that doesn’t suit your needs and proves to be expensive in the long run.

Whether you’re exploring Toronto homes for sale, eyeing houses in Kitchener, or considering pre-construction homes, you must understand the intricacies of mortgages for easier transactions. Honest communication and being knowledgeable and well-prepared will help you steer clear of problems or legal tangles.

Whether you are a first-time home buyer or renegotiating an existing mortgage, a mortgage application requires attention to detail. We help you through the steps and considerations when successfully applying for a mortgage in Real Estate Canada.

Table of Content

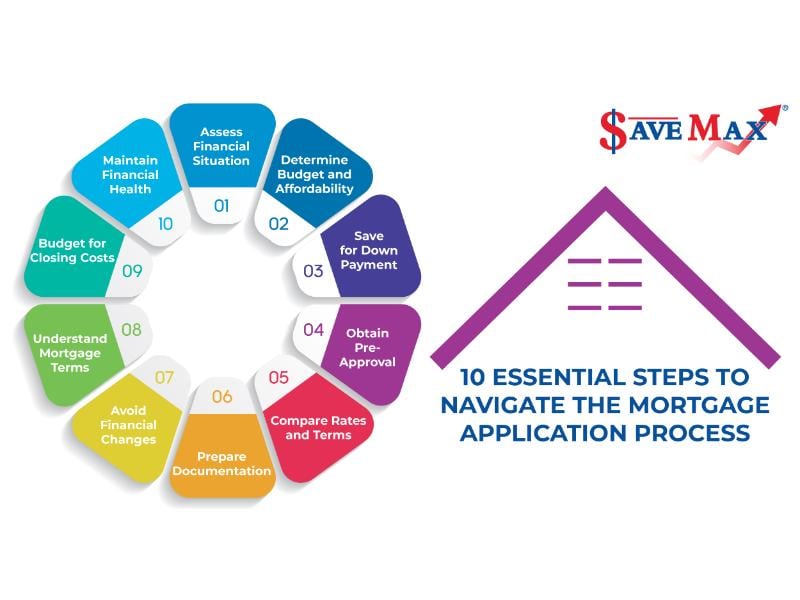

- 1 Step 1. Assess Your Financial Situation

- 2 Step 2. Calculate Your Budget and Affordability

- 3 Step 3. Save for a Down Payment

- 4 Step 4. Get Pre-Approved for a Mortgage

- 5 Step 5. Compare Mortgage Rates and Terms

- 6 Step 6. Gather the Necessary Documentation

- 7 Step 7. Avoid Major Financial Changes

- 8 Step 8. Read and Understand the Mortgage Terms

- 9 Step 9. Include Closing Costs

- 10 Step 10. Maintain Good Credit and Financial Health

- 11 Bonus Tip: Seek Professional Advice

- 12 Information is the Key!

Step 1. Assess Your Financial Situation

Before starting the mortgage application process, take an objective look at your financial situation. Money, or the lack of it, is the foundation of your financial report card!

Begin by assessing your current income and debt obligations. Get your latest credit score. All these actions will help you understand your finances and give you a clear picture of what you can afford. Making a cash flow analysis helps avoid surprises during the actual application process.

A stable job and a steady income will effectively demonstrate to lenders that you can meet your mortgage payments.

Step 2. Calculate Your Budget and Affordability

Determining your budget and affordability plays a huge role when applying for a mortgage. Use a mortgage calculator to estimate your monthly mortgage payments. Play around with different interest rates and down payment amounts to zero down on what is doable.

Remember to consider other associated costs, such as property taxes, insurance, and maintenance expenses. If you do this diligently, you will know what you can comfortably afford without overextending yourself.

Step 3. Save for a Down Payment

A down payment is a crucial part of your mortgage, and the sooner you can start saving for it, the better it is. A large down payment means you borrow less and have lower monthly mortgage payments and interest costs.

Apart from personal savings, common sources for down payment funds include withdrawals from Retirement Savings Plans, gifts from immediate family members, proceeds from the sale of other properties, and borrowing against other assets.

The Canada Mortgage and Housing Corporation (CMHC) has specific down payment requirements for buying houses. For homes priced under $500,000, a minimum down payment of 5% is mandated. If the property is priced above $500,000, it is 5% for the first $500,000 and 10% for the remaining portion.

For instance, consider a house for sale in Kitchener priced at $600,000. The minimum down payment would consist of 5% of the first $500,000 ($25,000) and 10% of the remaining $100,000 ($10,000), totalling a minimum down payment of $35,000.

Step 4. Get Pre-Approved for a Mortgage

Obtaining a mortgage pre-approval is highly recommended before starting your home search, especially if you are a newbie to the industry.

A pre-approval will accurately estimate how much you can borrow and the interest rate you qualify for. It will also demonstrate to sellers that you’re a serious buyer, increasing your chances of securing your dream home.

To get pre-approved, you’ll need to provide documentation such as identification, bank account statements, proof of assets, proof of income, and information about your debts.

Step 5. Compare Mortgage Rates and Terms

When applying for a mortgage, shopping around and comparing mortgage rates and terms is part of the game. You must identify your mortgage needs and objectives, including your preferences regarding amount, rate, term, amortization, and conditions.

Different lenders offer various rates and conditions, so you must research and find the best option for your needs. You can consult a mortgage broker who can help you understand the process and negotiate on your behalf.

Remember that even a slight difference in interest rates impacts your monthly payments and overall mortgage costs. So, put on your hard negotiator hat and hustle for the best deal.

Step 6. Gather the Necessary Documentation

You will need to gather the necessary documentation to complete your mortgage application. If you are looking at semi-detached houses for sale in Mississauga or Brampton, ensure that you have the requisite paperwork handy to ensure a smooth application process.

This includes identification, bank account and investment statements, proof of assets, proof of income, and information about your debts. Stay in touch with your mortgage broker and promptly provide any additional documentation or information they may need.

Step 7. Avoid Major Financial Changes

When the process is ongoing, try to avoid making any life changes that could impact your finances and, thus, the application.

This includes zero major purchases, applying for new credit, or changing jobs. Lenders assess your financial stability and ability to repay the mortgage based on your current circumstances. Making sudden changes will raise red flags and potentially endanger your approval.

So, if you can postpone them, it is best to wait until after your mortgage is finalized before making any major financial decisions. If you wish to know more about saving on monthly payments without rocking the boat, read our blog on keeping your mortgage payments in check.

Step 8. Read and Understand the Mortgage Terms

This step is highly recommended, and most people don’t do it.

Before finalizing your mortgage application, carefully read and understand the fine print. The mortgage agreement will outline important details such as the interest rate, loan terms, and the mortgage amount you’ve been approved for.

Take the time to review each page and ask any questions you may have. Consult with an experienced lawyer or accountant to ensure you fully understand the terms and conditions.

Step 9. Include Closing Costs

In addition to the down payment, it’s important to plan for closing costs when applying for a mortgage.

Closing costs include legal fees, land transfer taxes, appraisal fees, and other expenses associated with purchasing a home. These costs can vary depending on the location and purchase price of the property. For example, Mississauga homes for sale will have more associated costs than those in Hamilton or Windsor.

Budgeting for these expenses will protect you from any financial surprises on closing day.

Step 10. Maintain Good Credit and Financial Health

Continue to maintain good credit and financial health throughout the mortgage application process.

Pay your bills on time, avoid taking on unnecessary debt, and regularly check your credit report for any errors or discrepancies. Lenders consider your credit history when assessing your mortgage application, so it’s important to demonstrate responsible financial behaviour.

Bonus Tip: Seek Professional Advice

Don’t hesitate to seek professional advice if you’re unsure about any aspect of the mortgage application process.

Mortgage brokers, real estate agents, and financial advisors are qualified to provide insights and guidance to help you make informed decisions. They have the expertise and experience to navigate the complex world of mortgages and will find the best mortgage solution for your needs.

When seeking assistance from a mortgage brokerage, broker, or agent in Ontario, verify their licensing status to ensure they meet the necessary standards to provide reliable services. The Financial Services Regulatory Authority of Ontario (FSRA) is the provincial regulator for the mortgage brokering industry.

Information is the Key!

Mastering a successful mortgage application in Canada requires careful consideration, especially if you are a first-time home buyer.

Though the primary reason for a mortgage is often to buy a house, homeowners can leverage their property’s value for renovations or investments. Understand your mortgage needs, objectives, and preferences regarding amount, rate, term, amortization, and conditions before applying.

There is no substitute for accuracy and transparency in your mortgage application. In addition, by following the tips in this article, you can increase your chances of securing the mortgage needed to purchase your dream home. Consult professionals wherever you feel out-of-your depth.

Stay financially prepared, proactive, and well-informed throughout the application process to achieve success and fulfill your homeownership goals.

Contact us for more information on mortgages, buying and selling property, or anything else you wish to know about Real Estate Canada.