Your Trusted Guide for First-Time Home Buyers – Great Government Initiatives in Real Estate Canada

The journey to buy your first home in Canada can be an amazing yet daunting prospect. From understanding the down payment rules to navigating through various incentive programs, a lot goes into becoming a homeowner in Real Estate Canada.

This comprehensive guide aims to break down this complex journey, making purchasing your first property a seamless and rewarding experience. This guide also provides valuable insights into the incentives available for potential homeowners, particularly first-time home buyers.

Table of Content

Real Estate Market Trends

The Canadian housing market has been experiencing significant growth over the past few years, with property prices and sales volumes increasing steadily. Whether you’re looking for Markham condos for sale or houses for sale in Kitchener, it’s crucial to understand the housing options available to make an informed decision.

Real estate trends vary from one region to another, with some areas experiencing a buyer’s market while others could be favouring sellers. Prospective buyers should research the specific market conditions in their preferred locations.

Housing Options in Canada

Canada offers a variety of housing options to cater to different budgets and lifestyle preferences. These include:

- Single-family homes are ideal for families seeking privacy and space.

- Semi-detached houses are perfect for those who want to balance privacy and community living.

- Townhouses are very suited to those looking for a community-oriented environment.

- Condominiums are the best choice for individuals and small families who prefer a low-maintenance lifestyle.

- Mobile homes are affordable for those willing to compromise on space.

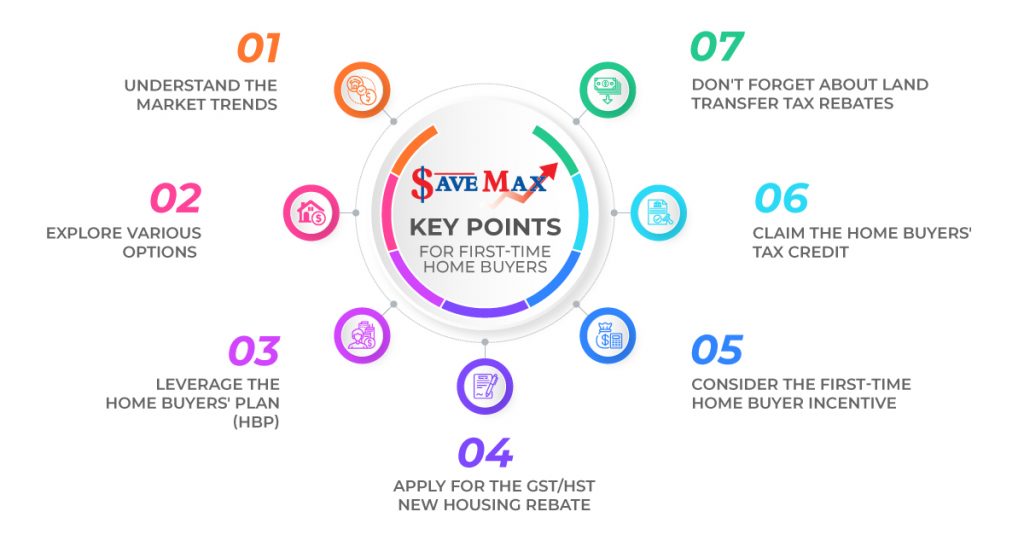

Critical Points for First-Time Home Buyers

To support first-time home buyers, the Canadian government offers several incentive programs. These incentives help offset home-buying costs, such as taxes, legal fees, and inspections.

We also list the key points a first-time home buyer in Real Estate Canada should remember when zeroing down on their purchase.

1. Understand Real Estate Market Trends: Knowing market trends helps buyers make informed decisions. Real Estate Canada can vary widely by region, so research housing supply, demand, interest rates, and economic indicators to gauge the market’s direction.

2. Explore Housing Options: First-time buyers can choose from various housing options, including condos, townhouses, detached homes, and more. Consider location, budget, lifestyle, and future needs to find the best fit.

3. Leverage the Home Buyers’ Plan (HBP): Administered by the Canadian Revenue Agency, the HBP enables first-time Canadian home buyers to withdraw up to $35,000 from their registered retirement savings plan (RRSP) to fund their home purchase.

A first-time home buyer must meet specific criteria, including agreeing to buy or build a house and intending to live in the purchased property within a year. The HBP is essentially a loan that must be repaid within 15 years, starting two years after the initial withdrawal.

4. Apply for the GST/HST New Housing Rebate: Purchasing a new construction property often comes with Goods and Services Tax (GST) or Harmonized Sales Tax (HST). This rebate enables buyers of newly constructed or substantially renovated homes to recover some of the GST or federal part of the HST incurred during the purchase.

To qualify, the property must have a fair market value of less than $450,000 once construction is complete and must serve as the buyer’s primary residence.

5. Considering the First-Time Home Buyer Incentive: The First-Time Home Buyer Incentive is a shared-equity mortgage program overseen by the Canada Mortgage and Housing Corporation (CMHC). Through this program, the federal government contributes 5% or 10% of the home’s purchase price towards the down payment, reducing monthly mortgage payments.

The government’s contribution must be repaid within 25 years or upon selling the house. While it reduces monthly mortgage payments, buyers should know and understand the repayment terms.

6. Claiming the Home Buyers’ Tax Credit: The HBTC offers first-time home buyers a non-refundable income tax credit of up to $5,000 during tax season. The credit can be applied to a wide range of residential properties, provided the home is occupied as the primary residence within a year of purchase.

While it won’t necessarily cover a significant portion of expenses, every bit helps manage home-buying costs.

7. Land Transfer Tax Rebates in Certain Provinces: Many provinces offer land transfer tax rebates to first-time buyers, lessening the burden of a substantial upfront cost. First-time home buyers can apply for a refund on their land transfer taxes in Ontario, British Columbia, and Prince Edward Island.

For instance, in Ontario, buyers can claim a province-wide rebate of up to $4,000 and an additional rebate of up to $4,475 if the property is in Toronto. Each province has different criteria and rebate amounts, so research the specifics in your area.\

Additional Programs and Initiatives

Canada offers various other programs and initiatives to support home buyers, as mentioned below.

The Rental Construction Financing Initiative facilitates new rental housing construction by providing developers low-cost loans. The CMHC Green Home Program rewards buyers of energy-efficient homes or those making energy-saving renovations with mortgage insurance premium discounts.

Affordable Housing Programs in different provinces and territories offer financial aid to low to moderate-income individuals and families seeking suitable housing. Energy-Efficient Mortgage Programs from select financial institutions allow buyers to borrow more for energy-saving home improvements.

The Home Adaptations for Seniors’ Independence (HASI) Program financially assists in making homes accessible and safe for seniors or people with disabilities. Indigenous Housing Programs cater to the unique needs of Indigenous communities, supporting housing construction, renovation, and repair.

Moreover, special programs exist for multi-unit properties, Northern territories, provincial homeownership incentives, and renovation support. To determine eligibility, terms, and the latest details, it’s advised to consult official government and financial institution websites.

Other Important Factors in the Home-buying Process

Now that you know more about the incentives and initiatives for home buyers, let us look at other significant steps on the journey to becoming a homeowner in Real Estate Canada.

Understand the Down Payment Rules

For first-time home buyers, understanding the rules for down payments is a significant first step. The Canada Mortgage and Housing Corporation (CMHC) mandatorily requires a minimum of 5% down payment for Canadian homes priced under $500,000 and 10% for any amount over $500,000.

Get Pre-Approval for a Mortgage

Securing a pre-approval for a mortgage is another integral piece of the process, as it lets you know how much you can afford. Your credit score significantly influences the interest rate on your mortgage and the lender’s willingness to grant you a mortgage.

Your mortgage broker will evaluate your credit rating, income, and outstanding debts during pre-approval. This assessment helps determine how much they will pre-approve you for and what interest rates they can offer.

Remember, the pre-approved mortgage amount is not fixed; it can vary based on the property’s valuation and other factors. Use a mortgage calculator to help get a budget in place.

Analyze Your Affording Power

Calculate your maximum purchase price once you have your down payment and pre-approval. Remember to factor in ownership costs like utilities, taxes, and possible condo fees—budget extra for maintenance and unexpected expenses.

Timing your first home purchase requires regular monitoring of market trends and news. If funds fall short for your chosen home, options include saving more or obtaining a mortgage based on your credit history from financial institutions. Consult a real estate professional to stay ahead of the game.

Frequently Asked Questions (FAQs)

1. How can I determine the maximum mortgage amount I qualify for?

The best way to determine this is through a mortgage pre-approval. A bank or mortgage broker will evaluate your credit score, income, and outstanding debts to determine the maximum amount they will lend you.

2. When is the best time to buy a property in Canada?

The best time to buy a property in Canada depends on several factors, including market trends, housing prices, and your budget. Keep a close eye on market updates to make an informed decision.

3. What if I face a shortage of funds for the housing I’ve selected?

You can consider holding off on the purchase until you’ve saved enough money, or you could go for a mortgage. Based on your credit history, financial institutions may lend you the amount you’re falling short of.

4. What are the benefits of getting pre-approval for a mortgage?

Getting a pre-approved mortgage allows you to understand your mortgage affordability, plan beforehand, lock in your interest rate, represent yourself as a serious buyer to lenders, and carry no financial or legal obligations.

5. How do I increase my credit score to improve my mortgage approval chances?

Your credit score can be increased by paying bills on time consistently, keeping your credit utilization low, maintaining a healthy mix of credit, and avoiding applying for new credit unless necessary.

Conclusion

Embarking on your journey into Canada’s real estate market may feel overwhelming. Yet, armed with the right insights and awareness of the incentives at your disposal, it can be truly rewarding. Conduct thorough research, align your housing needs, assess your budget, and leverage the tailored incentives for the first-time home buyer. Should you have any doubts, don’t hesitate to seek expert guidance.

While navigating the intricacies of purchasing your first home, equipping yourself with the correct information and preparation can simplify the process remarkably. Explore insights into Real Estate in Canada with our series of infographic blogs tailored to empower and educate those interested in Canadian real estate.

Let these blogs serve as your guide to unlocking opportunities and embracing the array of incentives designed for home buyers.