Save Max’s Mortgage Calculator Helps You Afford Your Dream Home

Were you thinking of buying your dream home but feeling overwhelmed by the financial aspects?

Don’t worry; you’re not alone! For most Canadians, buying their home is the most significant investment they will ever make.

With Canada’s homeownership rate at around 66.5%, it’s clear that homeownership is a dream shared by many. And with the average home price in Real Estate Canada reaching $686,371 in March 2023, a mortgage can make this dream more affordable.

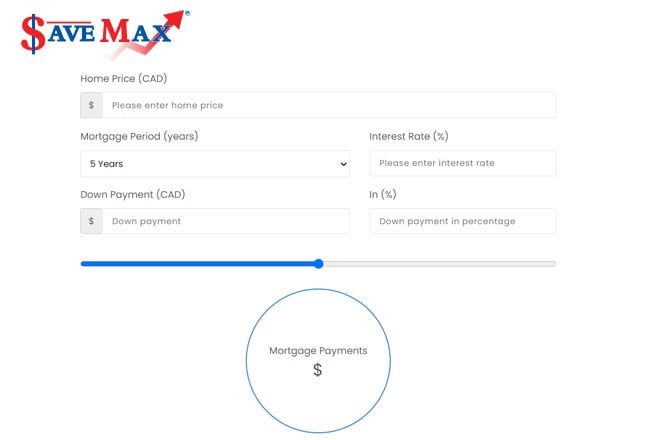

A large percentage of Canadians finance their dream home through a mortgage. The Save Max Mortgage Calculator takes the guessing out of the process, making it more straightforward to understand the costs and calculate your monthly payments.

Table of Content

What is a Mortgage Calculator?

A mortgage payment calculator is an online tool that helps you estimate your mortgage payments based on the property’s purchase price, downpayment, interest rate, and mortgage term. Using the Save Max mortgage calculator, you can better understand your cash flow, how much you can borrow and plan your budget accordingly.

Using a mortgage calculator can help you increase your savings by allowing you to explore various mortgages and find the best one for your financial situation. By entering information such as your down payment, interest rate, and loan term, you can estimate the monthly mortgage payments and the total cost of your loan over time.

The results let you compare different mortgage options and choose the lowest total cost. Use our mortgage calculator to compare various down payment amounts or loan terms to see how they impact your monthly payment and the total loan cost.

By finding a mortgage option that offers lower monthly payments and total cost, you can maximize your savings and potentially save thousands of dollars over the life of the loan. The Save Max Mortgage Calculator can help anyone looking to purchase a home or commercial rental property, refinance an existing mortgage, or compare various real estate investment options.

Components of a Mortgage

Calculating a mortgage involves several components, including the loan amount, interest rate, term, and down payment. Understanding these components and how they affect your mortgage payments helps you choose the right mortgage for your needs.

- The loan amount is the borrowed amount, which forms the basis for calculating the interest rate.

- When money is borrowed, you need to pay an annual cost known as the interest rate. This percentage of the loan amount is added to the principal amount. The interest rate directly affects your monthly payments and the money you must repay. When you opt for higher interest rates, you will have higher monthly payments and a more extended period to repay the loan.

- The mortgage term is the period for which the loan is taken, typically 15 or 30 years. A shorter loan term generally means higher monthly payments but lower total interest paid over the life of the loan.

- Another crucial component of mortgage calculation is the down payment, which is the money paid upfront to reduce the loan amount. Larger down payments mean a lower loan amount and less interest. Some lenders also require a minimum down payment of 5% or 20% of the home’s purchase price, depending on the loan program and borrower’s creditworthiness.

Other factors affecting mortgage calculations include property taxes, homeowner insurance, and private mortgage insurance (PMI).

Local governments assess property taxes typically based on the home’s value. Homeowners insurance protects the property from damage, and most lenders require it. If a mortgage has a less-than-20% down payment, Private Mortgage Insurance is required to protect the lender against borrower defaults.

Using a Mortgage Calculator

Using our mortgage payment calculator tool is simple. Enter the house price, down payment, and other financial details, and the calculator will estimate your monthly mortgage payments. You can adjust the variables, such as interest rates and amortization periods, and see how different factors affect your payments.

With the mortgage calculator, you can analyze your cash flow, make more informed decisions when shopping for mortgages and save money by avoiding mortgages that are too expensive or don’t fit your needs.

The Next Step – Qualifying for a Mortgage

After using the Canadian mortgage calculator, the next step in the home-buying process is to qualify for a mortgage. This requires meeting the lender’s criteria for obtaining a home loan, which determines how much money you can borrow and the interest rate.

Getting pre-approved for a mortgage is essential to help you understand your mortgage limit and monthly mortgage payments. Obtaining pre-approval for a mortgage not only helps you understand how much you can spend but also shows Realtors and sellers that you are a committed buyer. In a competitive housing market such as Toronto or Brampton, pre-approval gives you an added advantage over other buyers who have yet to take this step.

To get a pre-approved mortgage, the lender will need detailed financial information, including income, credit history, and debt levels. After reviewing your financial information, the lender will assess your creditworthiness, determine the loan amount you qualify for, and the corresponding interest rate for the mortgage. This process typically involves a credit check, which allows the lender to assess your creditworthiness and determine your eligibility for a loan.

Simplifying Mortgages, Saving Money

Save Max’s Mortgage Calculator simplifies determining your home affordability and monthly mortgage payments. This tool is particularly beneficial for a first-time home buyer or new immigrant to Canada who needs to familiarize themselves with the mortgage process.

Save Max believes in making homeownership accessible to everyone, and our mortgage calculator helps simplify the process. With the best real estate website in Canada at your fingertips, you can confidently shop for the best property investment and realize your dream of owning a home while maximizing your savings.