Preparing Children for Homeownership: A 3-Step Guide for Canadian Parents

Did you know that parental property ownership significantly influences homeownership in Canada? Individuals whose parents own homes are more than twice as likely to own one themselves, becoming proud first-time home buyers.

Statistics Canada’s recent report reveals that the homeownership rate among Canadians born in the 1990s is 17.4% if their parents own property, compared to just 8.1% if their parents don’t. Notably, if parents own multiple properties, their children’s homeownership rate increases to 23.8%.

The analysis emphasizes a positive relationship between parents’ property ownership and their adult children’s likelihood of owning a home, even when considering income, age, and province of residence. As housing affordability challenges persist, this underscores the crucial role of the “mom and dad” in facilitating homeownership for the younger generation.

Table of Content

Prepare Your Child for Homeownership

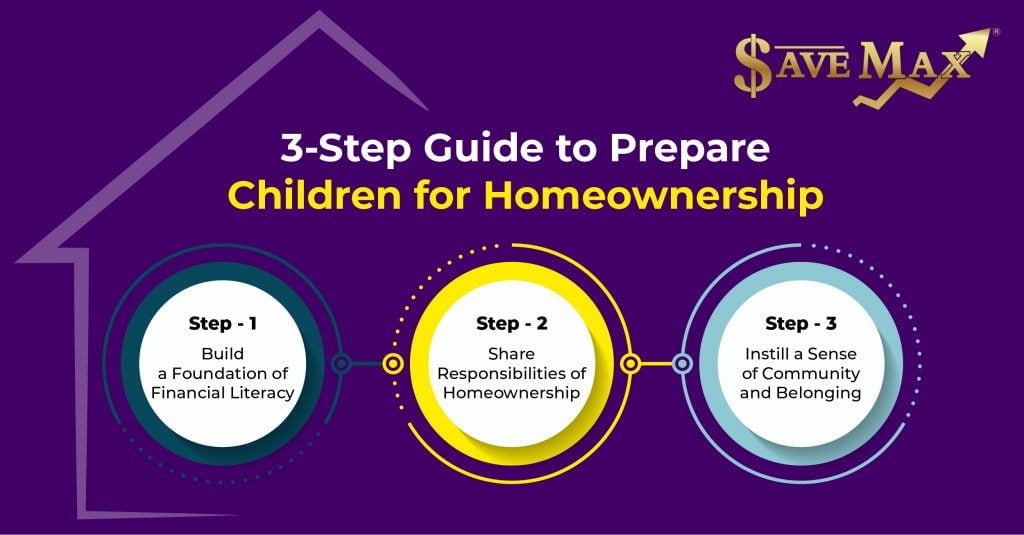

Educating children about homeownership is crucial in setting them up for future success. Homeownership provides stability and security and fosters financial responsibility and personal growth. Parents can empower children to make informed decisions about their future housing choices. This guide will explore three steps for Canadian parents to prepare their children for financial stability and homeownership.

Step 1: Build a Foundation of Financial Literacy

One of homeownership’s fundamental aspects is understanding finances. Teaching children about money management, budgeting, and saving from an early age equips them with the skills they need to make informed financial decisions in the future. Here are some strategies to help build a foundation of financial literacy:

Teach the Value of Money

Encourage children to set savings goals, understand the value of money, and make responsible choices regarding spending. Children will better understand financial responsibility when involved in financial discussions and decision-making.

Introduce Budgeting

Teach children the importance of budgeting by involving them in household financial planning. Help them understand how to allocate money for different expenses, including savings for future goals such as homeownership.

Instill Saving Habits

Encourage children to save a portion of their allowance or earnings. Teach them about the benefits of delayed gratification and the long-term rewards of saving. Consider setting up a savings account for them and discuss the concept of compound interest.

Provide Real-Life Financial Experiences

Allow children to experience financial decision-making and cash flow analysis through tasks such as managing their allowance, tracking expenses, and saving for specific items or goals. These experiences will help them develop crucial financial skills.

Step 2: Share Responsibilities of Homeownership

Owning a home comes with the responsibility of maintenance and upkeep. Teaching children the importance of caring for their living space helps them develop a strong work ethic and a sense of responsibility. Here are some ways to share the responsibilities of homeownership with your children:

Cleaning and Organization

Encourage children to participate in household chores, including cleaning and organizing. Teach them the importance of maintaining a clean and tidy living environment.

Basic Repairs and Maintenance

Involve children in basic repairs and maintenance tasks around the house. Teach them practical skills such as changing light bulbs, fixing minor plumbing issues, or painting walls. This hands-on experience will teach them valuable skills and instill a sense of pride in homeownership.

Gardening and Landscaping

Engage children in gardening and landscaping activities. Teach them about the importance of maintaining outdoor spaces and their positive impact on a home’s aesthetics and value.

Step 3: Instill a Sense of Community and Belonging

Homeownership provides a sense of belonging and community. Instilling a sense of community in children can help them develop a solid connection to their neighbourhood and foster a sense of stability. Here are some strategies to help children understand the importance of community:

Participate in Community Activities

Encourage your children to participate in community activities such as local events, volunteering, or joining clubs or organizations. This involvement helps them develop a sense of belonging and social responsibility.

Engage with Neighbors

Encourage your children to engage with their neighbours through simple interactions or building lasting relationships. Teach them the value of being a good neighbour and the benefits of having a supportive community.

Explore Local Amenities

Take the time to explore local amenities with your children, such as parks, libraries, and community centers. This will help them appreciate the resources available in their community and develop a sense of pride in their surroundings.

Help Your Child Become a Homeowner

Real Estate Canada is a fiercely competitive housing market where property prices are soaring. Naturally, many parents aspire to assist their children in securing a place to call their own.

For those fortunate enough to possess the means, extending a helping hand is a practical investment. It is also a source of immense pride and joy for parents to see their children as first-time home buyers.

If you wish to help your child become a homeowner, you can choose one of the following strategies.

1. Rent Out a Room in Your Home

If your children are young adults moving back home due to rising living costs, they can benefit from discounted rent. Consider local room rates, shared expenses, and your child’s financial goals. Establish fair terms, considering their contribution to household tasks or projects. Use tools like a home affordability calculator for guidance.

2. Financial Assistance through Loans

Offering a loan for a home purchase can be mutually beneficial. Discuss interest rates with a professional, aiming for a rate between conventional loans and average investment yields. Address tax implications and ensure a clear agreement. Loans over $15,000 without interest may be treated as gifts, affecting tax responsibilities.

3. Gifting Money for Buying a Home

Providing a financial gift aids your child’s home-buying journey. Gift letters clarify the nature of the contribution, assuring lenders it’s not a loan. Consult with home loan specialists and tax professionals to optimize the gift strategy. Understand your child’s comfort with receiving a significant gift and consider alternative contributions like home-related items.

4. Co-signing and Joint Homeownership

Co-signing a mortgage combines credit histories, helping your child secure a larger loan. However, potential downsides include liability for missed payments and credit implications. Use a mortgage calculator and assess your child’s financial responsibility before committing.

Be aware of legal and financial consequences in case of defaults, bankruptcy, or government assistance applications. Clarify expectations and responsibilities before co-signing.

5. Direct Purchase or Gift of a Home

Some families can afford to buy a home for their children, offering a substantial financial advantage. However, navigate gift tax implications by transferring ownership gradually. Seek advice from experts to ensure compliance. Treat the transaction like any other, and involve professionals for mortgage approval, inspections, and purchase agreements.

Assess your child’s needs, financial capabilities, and your situation before deciding. Open communication, professional advice, and clear agreements are essential for successful home-buying assistance.

Conclusion

Preparing children for financial stability and homeownership is a crucial step in setting them up for success in the future. By building a foundation of financial literacy, sharing responsibilities of homeownership, and instilling a sense of community and belonging, parents can empower their children to make informed decisions and thrive in their future housing endeavours.

Choose the Best Realtor – Open Houses in Canada

Start early, engage them in meaningful conversations, and provide opportunities for hands-on experiences that will shape their understanding of homeownership and financial responsibility.

Remember, educating children about homeownership benefits them and contributes to positive civic outcomes and societal dividends that extend beyond the individual homeowner. By preparing the next generation for homeownership, we are investing in the future of our communities and country.