Housing Prices Over The Last 25 Years

There is one important question on every homeowner’s mind right now in Canada. How much is my home worth and how much has the value appreciated since I bought it?

This is mainly because right now, the Canadian housing market has shot up in value. In many provinces, it costs an estimated $1 million (Canadian) to buy an average detached home in a suburban area.

History Lesson in Home Prices

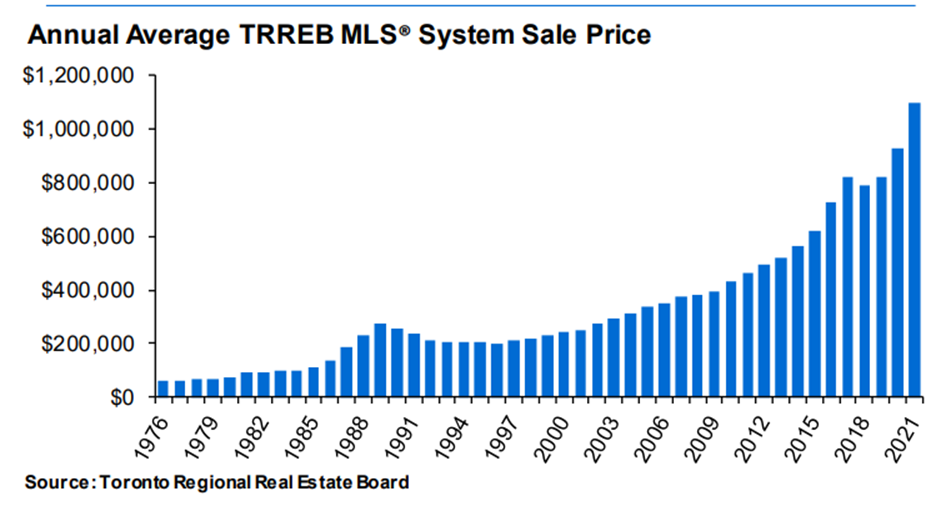

It is relevant at this point to go back in history and see what has happened to home prices in the last 25 years – the tenure (amortization) of an average mortgage essentially. There is one graph that says it all. And there is one calculator that explains it all – The CAGR (compound annual growth rate) calculator, which is available online, for free.

If you examine this for a minute, you will see that the average home price was around $198,150 in 1996. The average home price in 2021 was around $1,095,419.

Note: Toronto in 1998 included Brampton, Mississauga, Etobicoke, Scarborough, etc It later became known as Toronto and Greater Toronto area and separated into cities.

If you want to know what your home is worth today, you can use the What’s My Home Worth tool on Save Max.

If you need any assistance with a detailed home evaluation, don’t hesitate to reach out to us using the form below. One of our local agents will get in touch with you shortly.

Reach Out To Us

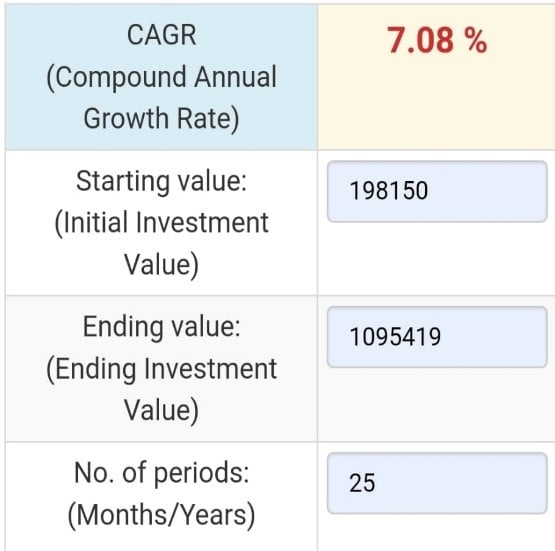

Now, let us pull up the CAGR calculator and put in the figures to calculate the compound annual growth rate.

Over the last 25 years, the compounded growth rate of home prices is 7.08%.

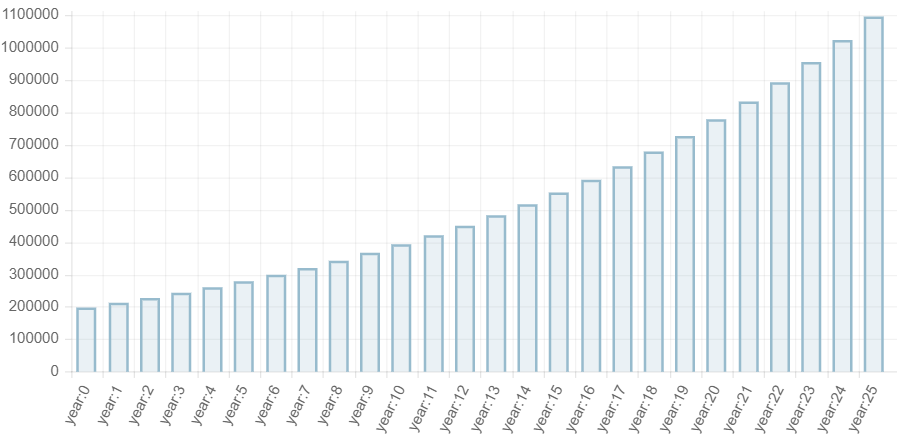

This is a graphic image showing the nominal straight-line calculation of price growth over 25 years. If you would like to know the real value, you will have to consider the carrying costs for the same period (i.e., the interest that you pay on your mortgage, property taxes, maintenance, repairs of your home) and the average annual headline inflation for the same period. This must be subtracted from the compounded annual growth rate.

Although, you may feel that the 7.05 % compounded growth rate is on the lower side, please remember that the costs of the house diminish over the years of your ownership. So, when you finish paying your mortgage, the value of your home has risen exponentially. Therefore, it is never the wrong time to buy your home.

To know more about whether house prices will rise in 2022, do watch this short video.

Look no further than www.savemax.com for your real estate queries. Contact us so that our agents can guide you through the process of buying or selling your home.