What You Need to Know About GTA Real Estate Investment Trends in 2023

The Greater Toronto Area (GTA) holds the most significant position in Canada as a hub of economic, social, and cultural activity. The GTA includes the City of Toronto and the Durham, Halton, Peel, and York municipalities, each contributing to the region’s unique character.

Canada has a population of over 39.5 million, and a staggering 25% reside within a 160-kilometre radius of Toronto. Undoubtedly, the Greater Toronto Area is vital to the country’s economy and real estate Canada markets. A rich, multicultural blend of metros, urban centres, suburbs, and rural landscapes, the region is a magnet for global talent and offers its residents a high quality of life.

Table of Content

GTA’s Impact on Real Estate Canada

The GTA’s impact on Canadian real estate prices is substantial for several reasons. First and foremost, the largest city in the GTA, Toronto, is also the financial and economic hub of the country. It is home to major industries, including finance, technology, media, and entertainment, attracting a diverse range of professionals and businesses. Toronto’s strong economic growth and employment opportunities make it an irresistible destination for people looking to live, work, and invest in real estate.

GTA offers various housing options, from urban condominiums to suburban single-family homes, catering to different preferences and lifestyles. The availability of amenities, quality education, healthcare facilities, and recreational opportunities further enhance the appeal of the GTA for potential homebuyers.

As a major economic centre, any developments in the GTA have a ripple effect on the real estate Canada market. Trends and price movements in the GTA often set the tone for other regions in Canada, influencing market conditions and buyer behaviour on a broader scale. Greater Toronto Area and Metro Vancouver are the country’s most competitive and sought-after housing markets.

The GTA Housing Market in April 2023

In April 2023, the average home price in the Greater Toronto Area (GTA) reached $1,153,269, the highest observed since May 2022, following a 23-month price low.

| The Average Price of Houses in the GTA | |

| Detached homes | $1,489,258 |

| Semi-detached homes | $1,135,599 |

| Freehold townhouses | $1,093,560 |

| Condo townhouses | $868,997 |

| Condos | $724,118 |

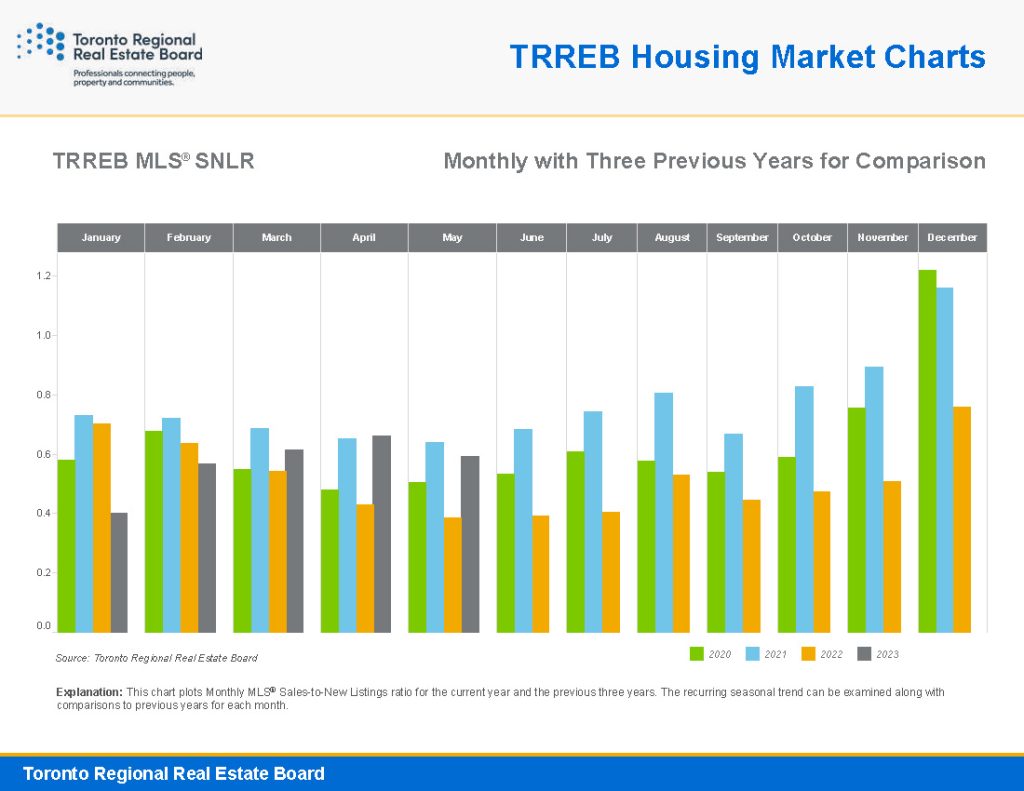

While sales in the GTA housing market (7531) declined slightly compared to April 2022 on a year-over-year basis, there was a significant decrease of over one-third in new listings (11,364). This reduction in listings relative to sales created a sales-to-new-listings ratio (SNLR) of 66%, resulting in an upward trend in selling prices.

Note: An SNLR above 60% typically signifies a seller’s market, where homebuyers face heightened competition due to a limited supply of homes. This increase in competition often leads to higher prices, favouring sellers but making it difficult for buyers to find properties at affordable prices.

Market Improvements in May 2023

In May 2023, the GTA housing market continued showing signs of improvement in sales. However, the inventory of homes for sale fell short of the increasing demand of home buyers. The sales-to-new-listings ratio increased significantly compared to the previous year, indicating a steep increase in buyer competition. The average selling price of houses for sale in Toronto rose to about $1.2 million last month.

GTA REALTORS® reported a substantial increase in sales, with 9,012 transactions recorded through TRREB’s MLS® System in May 2023, representing a 24.7% surge compared to May 2022. Conversely, new listings experienced an 18.7% decline over the same period. When adjusted for seasonal fluctuations, sales in May also saw a 5.2% increase compared to April 2023.

TRREB President Paul Baron commented on the market dynamics, stating that the board’s predictions of a gradual improvement in sales and average selling prices are coming true.

The demand for housing has significantly surged in recent months. Many homebuyers have adjusted their housing needs in response to higher borrowing costs and are re-entering the market. Additionally, a growing rental market and record population (fuelled by immigration) have contributed to increased home sales.

However, a low inventory of homes is pushing prices due to the high demand from buyers during the spring season. In May 2023, the average sales price to listing price ratio was 103%, meaning homes sold for 3% more than their asking prices on average. This ratio is higher than the 101% observed last month, and it’s the first time it has been above 100% since May 2022

Demand, Supply and Initiatives

Housing affordability and the lack of supply are significant concerns in the City of Toronto, reflecting a broader challenge in the GTA region. The demand for affordable housing grows proportionately with the increasing population.

Canada Mortgage and Housing Corporation (CMHC) experts predict that the country will need over 3 million additional homes by 2030 to address housing affordability for the growing population. With immigration expected to reach 431,000 in 2022 and the government targeting the entry of another 900,000 newcomers in 2023 and 2024 combined, current home-building projections will need upgrading. There is a pressing need for housing supply to keep pace with the rising population to prevent negative impacts on the region’s economic development.

Government Measures

Toronto and the GTA are popular destinations for immigrants and need help providing sufficient housing to accommodate the growing population.

To cope with the looming housing crunch, the city has recently permitted the construction of self-contained residential dwellings in backyards. Suburban areas surrounding the City of Toronto are expected to expand as the city grows.

The City of Toronto has developed a comprehensive work plan for the Housing Action Plan 2022-2026. This plan outlines a robust strategy to address the pressing issues of housing supply, housing choice, and affordability for current and future residents. The aim is to surpass the provincial housing target of 285,000 new homes by 2031.

There is a growing focus on vertical development. While low-rise houses have been traditional, there is a clear shift towards high-rise condominiums. Vertical housing and condos within the GTA are poised to dominate the real estate landscape moving forward.

Investing in condos is becoming attractive, particularly in metros and urban areas with abundant employment opportunities. Additionally, real estate investors can buy two apartments for the price of a detached house for sale in Mississauga, with the potential for higher returns.

Concluding

Investors increasingly know more about real estate and show growing interest in the market. Many Canadians plan to purchase an investment property in the next five years. Strong employment levels and increases in immigration are fuelling the demand for housing, with single-family homes and condos being the popular investment choices in the Greater Toronto Area.

The area’s significance in Real Estate Canada stems from its economic prominence, cultural appeal, population growth, and role as a market trendsetter. However, affordability concerns persist in the GTA, and some experts suggest that there may be another interest rate hike by summer.

Weighing up the pros and cons, Investing in real estate remains an attractive option for GTA investors who have confidence in the profitability of real estate. Start your homeownership journey today, and your dreams of owning a home in the vibrant GTA region may soon become a reality.