Do You Qualify for the First-Time Home Buyer Incentive in Canada?

Table of Content

For many, buying a house is one of the most momentous events in their lives. This is an exciting process for some though others may find it daunting, especially if they are unprepared for the challenges of choosing the right property.

Having said that, it is not a very complicated process if you do your homework and have a fair idea of what you are looking for. As always, an excellent real estate brokerage can smooth the way considerably.

The Average Home Price in Canada

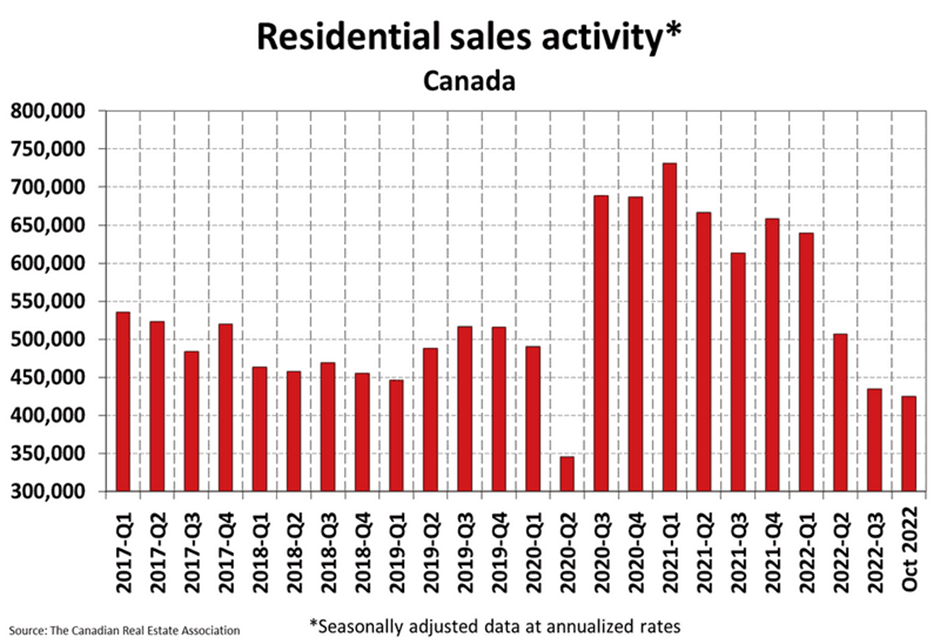

Following several interest rate hikes by the Bank of Canada this year, many potential buyers have paused their plans. It can be a tough decision for first-time home buyers to foresee where the Canadian real estate market is headed and whether they should wait or buy now.

In addition, housing affordability is a concern and home sales fell by 3.9% between August and September 2022.

However, according to the Canadian Real Estate Association (CREA), the slowdown in Canadian housing markets is winding up, with house sales increasing in October 2022.

The actual national average home price was $644,643 in October 2022, down 9.9% from October last year. However, be prepared for higher housing prices in major cities such as Toronto and Vancouver.

Investing in Real Estate

Real estate investments are an excellent way to create an income-generating source and a popular mainstay in financial portfolios. With lower interest rates and demand outstripping supply, the Canadian real estate market has been a steadily growing sector. And you get the chance to build equity.

A Quick Look at the Home-buying Process

The decision to buy a house depends on your income, career stability and whether you know where you will be in 3 to 5 years. You need to consider the inevitable maintenance and renovation costs and ensure that you can afford the place you wish to live in for at least several years.

Though other factors come into play when you decide to buy a house, the most critical determiner is whether you have the money – for the down payment, monthly mortgage payments, and other costs such as closing costs, Inspection & Appraisal fees, Insurance and so on.

The best way to go about buying a house is discussed below.

Build Your Savings

The first step is to build your savings – preferably in a Registered Retirement Savings Plan (RRSP) or a Tax-Free Savings Account (TFSA)

An RRSP allows you to save money for your retirement, and you don’t pay taxes on your savings until you withdraw money. On the other hand, the amount contributed to a TFSA and any income earned in the account is generally tax-free, even withdrawals.

Good Credit Report

Maintaining a credit score of at least 660 gives you better chances of getting a mortgage or other lending options at lower mortgage interest rates. A stable, steady income is an added advantage.

Plan Your Finances

The next step is determining how much you can afford to pay for a house. Your housing expenses plus other debts, divided by your gross income, give the Total Debt Services ratio – this, along with the amount for a down payment, helps you to arrive at a figure.

According to Canada Mortgage and Housing Corporation (CMHC), monthly housing costs should not exceed 35% of gross monthly income. Your monthly debts should not exceed 42% of your gross monthly income, including your mortgage payments and all other debts.

Next, look at properties that tick the boxes for location and budget. You must factor in commute time, public transit, neighborhood amenities, etc. Estimate the closing costs of the property and apply for mortgage pre-approval.

Mortgages and Down Payments

In the Canadian mortgage system, the home buyer pays a down payment and then avails a mortgage (from a bank or other lenders) for the rest of the purchase price. The mortgage is then repaid over a period of years, with an interest portion also being paid to the lender.

The minimum down payment for a new home is five percent of the home’s total cost. However, it is recommended to make a larger down payment – If you can pay a down payment of 20 percent or above, you are not usually required to pay for mortgage insurance.

Buying Your First Home

Buying your first home is a substantial commitment and should be made only if you have the minimum financial resources. But with increasing home prices, down payments may become a significant stumbling block for many investors, especially young people.

Government Incentives

The Government of Canada offers several financial incentives to make the home-buying process more accessible. The First time Home Buyer Incentive, Home Buyers Amount, Home Buyers Plan, Canada Greener Homes and the GST/HST New Housing Rebates are some programs for home buyers.

Programs like the First-Time Home Buyer Incentive and the Home Buyers’ Plan are available to homebuyers nationwide.

What is The First-Time Home Buyer Incentive?

The First-Time Home Buyer Incentive is a shared-equity mortgage with the Government of Canada. It helps the first-time homebuyer afford a larger down payment, leading to a smaller mortgage and lower monthly payments.

The Incentive

Qualified first-time homebuyers get 5% or 10% of the home’s price towards their down payment in exchange for equity in the property. Depending on the property, you can get up to:

- 5% incentive for existing, resale, or mobile/manufactured homes.

- 5% or a 10% incentive for newly constructed homes

Repaying the Incentive

The Government is repaid 5% or 10% of the market value after 25 years or when the property is sold, whichever comes first. Ongoing repayments are not required, and the incentive does not attract interest. However, the repayment is always made in one lump-sum payment for the total amount.

The homebuyer can repay the incentive at any time without a pre-payment penalty.

Maximum Repayment Amount

When paying back the Government, the homebuyer repays the same 5% or 10% share that they received through the incentive, but it is calculated as a percentage of the home’s market value at the time of repayment.

• In the case of appreciation, the incentive amount plus a maximum gain of 8% per annum (not compounded) on the incentive amount from the date of advance to the time of repayment; or

• in the case of depreciation, the incentive amount minus a maximum loss of 8% per annum (not compounded) on the incentive amount from the date of advance to the time of repayment.

The shared equity component of the incentive means that the government shares both the profit and loss in the property value.

Qualifying for the First-Time Home Buyer Incentive

The First-Time Home Buyer Incentive is for qualified first-time homebuyers only. You’re considered a first-time homebuyer if:

• you have never purchased a home before OR

• you have not occupied a home that you or your current spouse or common-law partner owned in the last four years OR

• you have recently experienced the breakdown of a marriage or common-law partnership (even if you don’t meet the other first-time home buyer requirements)

Only one spouse/common-law partner must meet the above requirements to qualify for the incentive.

Additional Criteria

In addition to being a qualified first-time homebuyer, you must meet a few additional criteria to determine your eligibility.

- The total annual income should not exceed $120,000 ($150,000 if the home you are purchasing is in Toronto, Vancouver, or Victoria)

- The total borrowing amount (mortgage principal + first-time home buyer incentive) must not exceed four times your qualifying income (4.5 times if the home you are purchasing is in Toronto, Vancouver or Victoria)

- You or your partner are a first-time homebuyer.

- You are a Canadian citizen, permanent resident or non-permanent resident authorized to work in Canada

- You meet the minimum down payment requirements with traditional funds (savings, withdrawal of a Registered Retirement Savings Plan (RRSP), or a non-repayable financial gift from a relative/immediate family member)

Other Qualifiers

The program is only available for CMHC-insured mortgages. Your down payment portion must be at least 5% but not more than 20% of the home’s purchase price.

Your property must be in Canada. It should be habitable and available for full-time, year-round occupancy for you to live in as your primary residence and can’t be used as an investment property.

The incentive may be associated with additional costs, such as legal fees, appraisal fees or property insurance premiums. Talk to your insurance broker to find out additional details.

How Do You Apply for the Incentive?

Once your pre-approved mortgage is in place, and you have found the home you want to buy, find out whether you can apply for the incentive.

If you are, fill out these two application forms to apply for the First-Time Home Buyer Incentive and give them to your lender for processing.

- FTHBI – SEM Information Package (PDF)

- SEM Attestation and Consent Form (PDF)

You can look up further information on how the incentive works on the CMHC website.

Conclusion

The First-Home Buyer Incentive aims to increase the buying power of Canadians so that they can buy a home of their own. The Canadian Government extended the First-Time Home Buyer Incentive to March 31, 2025, in its 2022 budget.

The incentive program has several advantages, but you need to look closely at your finances and budget. Remember, the government benefits from any increase in the home’s equity. It can be a good idea to make the repayment before undertaking any changes that will increase the home’s value. Otherwise, you might find yourself with a larger-than-expected incentive repayment.

We advise you to speak to a trusted Real Estate Brokerage to help you decide whether the First-Home Buyer Incentive is right for you.