Canadian Housing in Focus – Budget 2022–23

Table of Content

By N. Balani

New Ground-breaking Initiatives for Canadian Housing

This time, the budget revolved around the concerns about the Canadian housing market supply and sky-high prices. This came out front and centre as did the number of initiatives in the housing sector. Canada will ban most foreigners from buying homes for two years. Exceptions to the rule would be permanent residents, foreign students, and foreign workers.

Other measures announced in the budget were an attempt to improve Canadian housing affordability for the lower-income groups.

What is the FHSA?

Introduction of a new “Tax-free First Home Savings Account” (FHSA). First-time homebuyers under the age of 40 years in Canada can save up to $40,000 toward their first purchase of Canadian homes. Under this account, Canadian residents can contribute up to a lifetime maximum contribution of $40,00 subject to an annual amount of $8,000 per year starting from January 2023. There are certain limitations – Unused annual contribution room cannot be carried forward (unlike RRSP or TFSA contributions).

In addition, the Home Buyers Plan (HBP) is mutually exclusive to First Home Savings Account (FHSA). To explain this further, you can either use your dollars saved under the HBP or the FHSA account but cannot use both towards the purchase of your home.

Other Canadian Housing Initiatives

• The Government will invest $10 B in housing initiatives over the next 5 years.

• The Housing Accelerator Fund will have a purse of $4 billion to help municipalities update their zoning and permit systems to allow for speedier construction of residential to build 100,000 new homes.

• Co-op housing will get $1.5 billion in loans and funding

• Canadians struggling with housing affordability will get a one time $500 payment

• Full Taxation on profits as business income if the property is sold in less than one year

• Proposal to make all assignment sales of newly constructed residential housing taxable for GST/HST purposes

• Multigenerational Home Renovation tax credit which will provide up to $7.500 in support for constructing a secondary suite for a senior or adult with a disability.

Are these Initiatives Enough?

“Is that enough to meet the demand?”- this is the question here. Housing supply, as well as high prices, have been chronic issues in Canada.

It takes one to two years to get housing complexes or condos ready. Therefore, these initiatives certainly are a step in the right direction by the Government of Canada as announced in the budget 2022 – 23. However, market conditions will require more than double these initiatives, to improve. Of course, it will lead to an overall more balanced market.

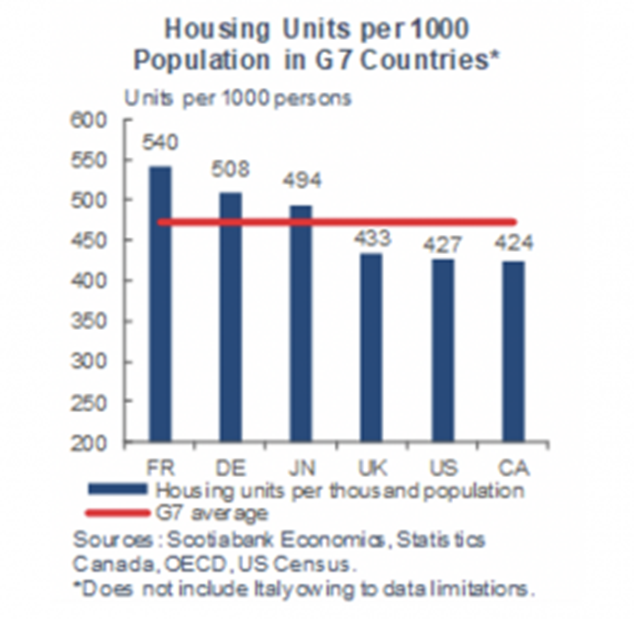

Here is an interesting chart to look at and make you think.

Canada has lower than average housing units per 1,000 population amongst the G7 countries (chart as of May 2021). Accordingly, to make good on the shortfall and catch up with the G7 average would mean building at least 1.8 million new homes.

A good point to note is that if you examine the sector, foreign investors comprise only 2 – 2.5% of the total home buyer’s market. The rest of the consumption is by residents who are buying second, third or even fourth properties as investments or rentals. To conclude, rather than the preventive measures (albeit a “temporary ban” of two years) on foreign investors, more work needs to be done in that direction.

To get more insights about the Canadian housing market trends, check out our blogs and news articles on our website. If you are looking to invest in a property, just fill in your dethttps://savemax.com/ails and we will get in touch with you.