An Updated Forecast of Home Prices in Canada for 2024

It is the tail-end of 2023, and the Canadian real estate market has been experiencing significant fluctuations. As several industry experts closely monitor the trends and make predictions for the coming months, TD Bank, one of Canada’s major financial institutions, has revised its forecast for home prices in the country, predicting a steeper drop than expected.

We explore the factors contributing to this forecasted decline and examine the impact on Real Estate Canada, including potential consequences for buyers and sellers.

Table of Content

- 1 The Revised Forecast: A Deeper Drop in Home Prices

- 2 Surge in Supply and Deterioration in the Sales-to-New Listings Ratio

- 3 Impact on Housing Demand and Buyer Behavior

- 4 The Role of Interest Rates and the Bank of Canada

- 5 Home Prices Above Pre-2020 Levels

- 6 Considerations for Buyers and Sellers

- 7 Conclusion: Navigating the Changing Landscape

The Revised Forecast: A Deeper Drop in Home Prices

TD Bank recently updated its forecast for home prices in Canada, projecting a 10% drop from their third-quarter level through the early part of 2024. This revised estimate is twice as steep as their previous projection of a 5% decline. The bank’s economists attribute this change to an upgraded bond-yield forecast and a larger-than-anticipated loosening in the housing markets of British Columbia and Ontario.

Surge in Supply and Deterioration in the Sales-to-New Listings Ratio

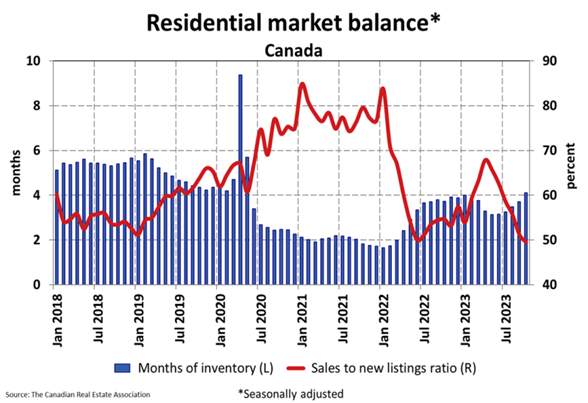

One of the key factors contributing to the downward pressure on home prices is the sudden surge in supply. TD Bank’s economists highlight the significant drop in Ontario’s sales-to-new listings ratio, which has plunged from 63% in May to 39% in October. This deterioration is primarily due to increased supply and a more prolonged drop in sales.

The sales-to-new listings ratio is a crucial indicator of market conditions, representing the number of existing home sales divided by the number of new listings. A lower ratio indicates a buyers’ market, suggesting sellers may have to adjust their expectations to attract buyers. The national sales-to-new listings ratio dropped to 49.5% in October, reaching a 10-year low.

Impact on Housing Demand and Buyer Behavior

The Canadian Real Estate Association (CREA) reported a sizable decline in sales in October, with home sales down 5.6% from the previous month. This decrease in sales activity suggests that many potential home buyers have become more cautious and are adopting a wait-and-see approach.

CREA noted that the October data indicates that many potential buyers have gone into hibernation, and some sellers may postpone their plans until the spring. The housing market is expected to remain suppressed until at least spring 2024, depending on factors such as the Bank of Canada’s interest rate decisions.

The Role of Interest Rates and the Bank of Canada

The Bank of Canada plays a significant role in shaping the housing market through its monetary policy decisions. TD Bank’s economists predict that the Bank of Canada will cut interest rates during the second quarter of next year. This potential rate cut will prevent further home price declines and sustain market demand.

However, the bank also acknowledges that this outlook has important downside risks, such as weaker economic growth or higher-than-expected interest rates. The central bank has gradually raised interest rates since March 2022 to cool the economy and dampen demand. The Bank of Canada aims to achieve price stability and a return to its two percent inflation target.

Home Prices Above Pre-2020 Levels

Despite the projected decline in home prices, TD Bank’s economists emphasize that the Canadian housing market would still be significantly higher than pre-pandemic levels. Even with a 10% drop, average home prices would remain 15% above pre-pandemic levels. This perspective reassures homeowners and sellers who may be concerned about potential losses.

It is important to note that various factors influence the housing market, and predictions are subject to change based on economic conditions, government policies, and market dynamics. TD Bank’s forecast is just one perspective among many, and it is essential to consider a range of expert opinions when assessing the future of the Canadian real estate market.

Considerations for Buyers and Sellers

For prospective buyers, the projected decline in home prices may present an opportunity to enter the market or upgrade to a larger property. However, first-time home buyers should carefully assess personal financial circumstances, including the ability to secure financing and manage monthly mortgage payments. Consulting with a mortgage advisor or financial planner can provide valuable guidance in navigating the current market conditions.

On the other hand, sellers may need to adjust their expectations and pricing strategies, including calculating their home’s worth, to attract buyers in a more competitive market. Working with a real estate agent with expertise in the local market can be beneficial in determining the optimal listing price and marketing approach.

Conclusion: Navigating the Changing Landscape

The Canadian real estate market is facing a period of transition, with TD Bank’s revised forecast suggesting a steeper drop in home prices than previously anticipated. However, it is essential to maintain a long-term perspective, considering that even with a projected decline, average home prices would remain significantly higher than pre-pandemic levels.

Buyers and sellers alike need to adapt to the changing market conditions and seek expert advice to make informed decisions. The Bank of Canada’s interest rate decisions will continue to play a crucial role in shaping the housing market and keeping abreast of economic indicators. Market trends will be essential for all parties involved.

As the Canadian real estate market evolves, staying informed and seeking professional guidance is crucial to navigating the changing landscape successfully. Contact us to help you on this challenging journey.