Right Time to Buy a Home in Vancouver, BC?

There are multiple reports about the housing markets in Canada – and some of them are actually true!

But yes, if you are a first-time home buyer in Vancouver and are waiting to see which way the wind is blowing before you jump in, it can be a tad confusing. On the one hand, there are more houses available, and prices seem to have stabilized, if not going down. The Bank of Canada has just announced its third rate cut last week and this seems likely to continue.

On the other hand, where are the houses that you can buy? Especially in the Greater Toronto Area and Greater Vancouver – the biggest and most influential markets in real estate Canada.

Well, join us as we decode the British Columbia market for you, with a more detailed look at Vancouver.

Table of Content

August 2024 Market Overview in British Columbia

BC is one of the most dynamic housing markets in Canada. Last month, the province showed signs of slowing down after a brief surge earlier in the year. In its monthly report, the British Columbia Real Estate Association (BCREA) highlights both the challenges and potential opportunities for buyers and sellers across the province.

In August 2024, residential sales across BC fell by 10% year-over-year, with 5,943 units sold through the Multiple Listing Service® (MLS®). The average price of a residential property also declined by 1.7%, landing at $938,500 compared to $955,063 a year ago.

Total sales volume in August was $5.6 billion and BC’s MLS® unit sales were 22% below the ten-year average for August, indicating a sluggish market. To date this year, the province’s residential sales total nearly $51 billion, with 51,505 units sold.

Despite the overall slowdown, BCREA’s Chief Economist continues to be optimistic. He noted that the lowering of interest rates for the third time and the consequent fall in fixed mortgage rates could drive more market activity in the Fall season.

It is also worth noting that the average price of homes has risen by 1.4% year-over-year, reaching $985,609. This trend suggests that while fewer units are being sold, a higher price is commanded by those that do sell, underlining a resilient property market.

Interest Rates and Seasonal Patterns

Like the rest of Canadian markets, the fluctuations in Greater Vancouver’s real estate market are closely tied to changes in interest rates. While lower interest rates typically boost buyer activity, this has not been the case so far.

The market’s response has been slower than expected, partly due to the lingering effects of high borrowing costs earlier in the year. Many potential buyers have adopted a wait-and-see approach in the hope of more attractive prices and lower mortgage rates.

However, there’s strong hope that the upcoming fall season will see more buyers enter the market, especially as interest rates decline further.

Greater Vancouver’s Market

Vancouver, one of BC’s key real estate markets, has faced a tricky journey in recent months.

August 2024 saw home prices in Greater Vancouver slip for the third consecutive month, with the current benchmark price standing at $1,195,900. Over the past year, prices have dropped 0.9%, with a reduction of $10,861 on average.

In themselves, these price drops are modest. And so far, Greater Vancouver has avoided the double-digit price corrections that other Canadian cities like Greater Toronto have seen. However, consecutive price declines may be an indicator of slower market reactions.

Sales also took a hit, with 1904 residential sales in August 2024, a 17.1% decline compared to last year. This figure is also 26% below the 10-year seasonal average, emphasizing the impact of buyer hesitancy and higher borrowing costs on the market.

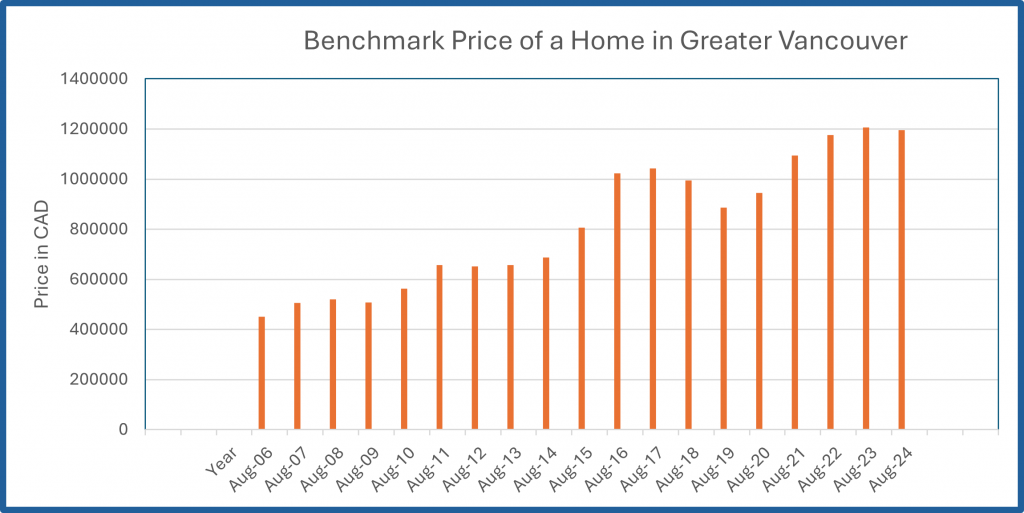

However, the benchmark price in Greater Vancouver shows a steady upward trend (albeit slower in the last couple of years) over a 20-year period. The graph below illustrates this trend, with numbers sourced from the BCREA.

A Closer Look at Inventory and Market Balance

Metro Vancouver saw a surge of new listings in August 2024, with 4,104 homes entering the market. This has pushed total inventory levels 20.8% above the 10-year average, leading to a drop in the sales-to-new-listings ratio (SNLR).

The SNLR dropped to 46.1%, down by 12.1 points compared to last year. However, despite the lower sales figures, the market just remains within a balanced range.

A Better Future for BC’s Real Estate Market?

When we look ahead at the market landscape in BC, it is evident that it is a rollercoaster. While the current sales and prices downturn might suggest a cooling market, the consecutive interest rate cuts could well trigger an uptick in demand.

It is more likely that buyers will have more negotiating power, given the inventory levels and slower-than-average sales, especially in Metro Vancouver. This means, that yes, it may be the right time for you to become a homeowner as you can potentially take advantage of lower mortgage rates.

If you are a seller, talk to a professional to understand the realities of the market. Be prepared to adjust your expectations, as buyers have more options, and you need to stay competitive.

While the near future may seem bleak, it is very likely that the Bank of Canada will continue easing interest rates and the fall market could bring its traditional resurgence in activity.

Finally, while the BC real estate market has softened this year, it has also managed to stay resilient, with opportunities for both buyers and sellers. Greater Vancouver will be a key area to watch in the coming months as it faces mounting pressure from rising inventory and tentative buyers.

The fall season could provide the spark needed to revive market activity, but only time will tell how the broader trends will unfold. But stay with us, and we shall keep you updated with the latest news and insights.

At Save Max, we prioritize accuracy and reliability in the information we share, making us a trusted source for all your property needs. Our Realtors are present across Canada, including Toronto, Mississauga, Brampton, Vancouver and Edmonton, ready to help you in your real estate journey.